SSA Part 0: SSA, DPD, 6CA, SCCC. What? Help!

There’s a lot of local news and apparent corruption around the area SSA, which involves two other entities, the 6CA and SCCC, but it’s confusing to understand what these organizations are and how they relate to one another, so let’s break it down:

What’s the Special Service Area (SSA)?

The Six Corners Special Service Area #28 (Six Corners SSA) is a local tax district, which was established in 2014, to impose a small special tax levy on property within the SSA’s boundaries to fund expanded programs and services. These typically include things like: public way maintenance and beautification; district marketing and advertising; business retention/attraction, special events and promotional activities; auto and bike transit; security; façade improvements; and other commercial and economic development initiatives. There are currently 52 SSA’s throughout the city, but our focus is limited to the Six Corners SSA. The citywide SSA program is administered by the City’s Department of Planning and Development (DPD).

The Six Corners SSA is overseen by seven Commissioners. The Commissioners are ultimately appointed by the Mayor, after vetting by DPD and in this case, as we’ll get into in another post, pressure from the Alderman. The Commissioners recommend to DPD what the budget and annual services should be, as well as who will be the Sole Service Provider (more on this shortly). While the Commissioners “recommend”, DPD has stated on the record that they almost always go with the SSA provided recommendations, their role is to provide guidance and ensure compliance with the letter of the law.

What’s the Six Corners Association (6CA)?

The Six Corners Association is a 501(c)6 non-profit economic development organization. From the beginning of the SSA, 6CA has been the designated Sole Service Provider. 6CA is governed by a board of area business owners and residents. You can see details about who is on their Board and Officers here. The role of the Sole Service Provider is to execute on the budget and priorities determined by the SSA. For example, if the SSA budgets $10,000 for snow removal, the Sole Service Provider typically puts out a Request for Proposal (RFP) to area snow removal vendors and then awards one of them an annual contract for the year based on the SSA approved budget.

What’s the Six Corners Chamber of Commerce (SCCC)?

The Six Corners Chamber of Commerce is a non-profit formed by Joe Angelastri, Joe Oliveri, and Mike Dimeo. Their federal tax-exempt status is unknown. Their governance structure, board members, and staff are all unknown. At the time of this writing, no details are provided on their site. In late 2019, the SCCC listed Anne Kamykowski as Interim Executive Director. Kamykowski was previously with the Jefferson Park Chamber until she was fired for failing to file grant paperwork which lost the Chamber the bulk of their funding. Her husband was formerly with the Ravenswood Chamber where he failed to pay over $40,000 in payroll taxes. The SCCC now has the primary contact listed as “Marlena” with no last name and a phone number that goes to Joe’s primary business, City Newsstand.

The most recent event listed on their site was May 21, 2019, a special event with Alderman Gardiner, the day after he was inaugurated. The SCCC Facebook page is almost entirely comprised of updates from Alderman Gardiner. This is the organization Gardiner and his new SSA want to hand the 2021 service provider contract to.

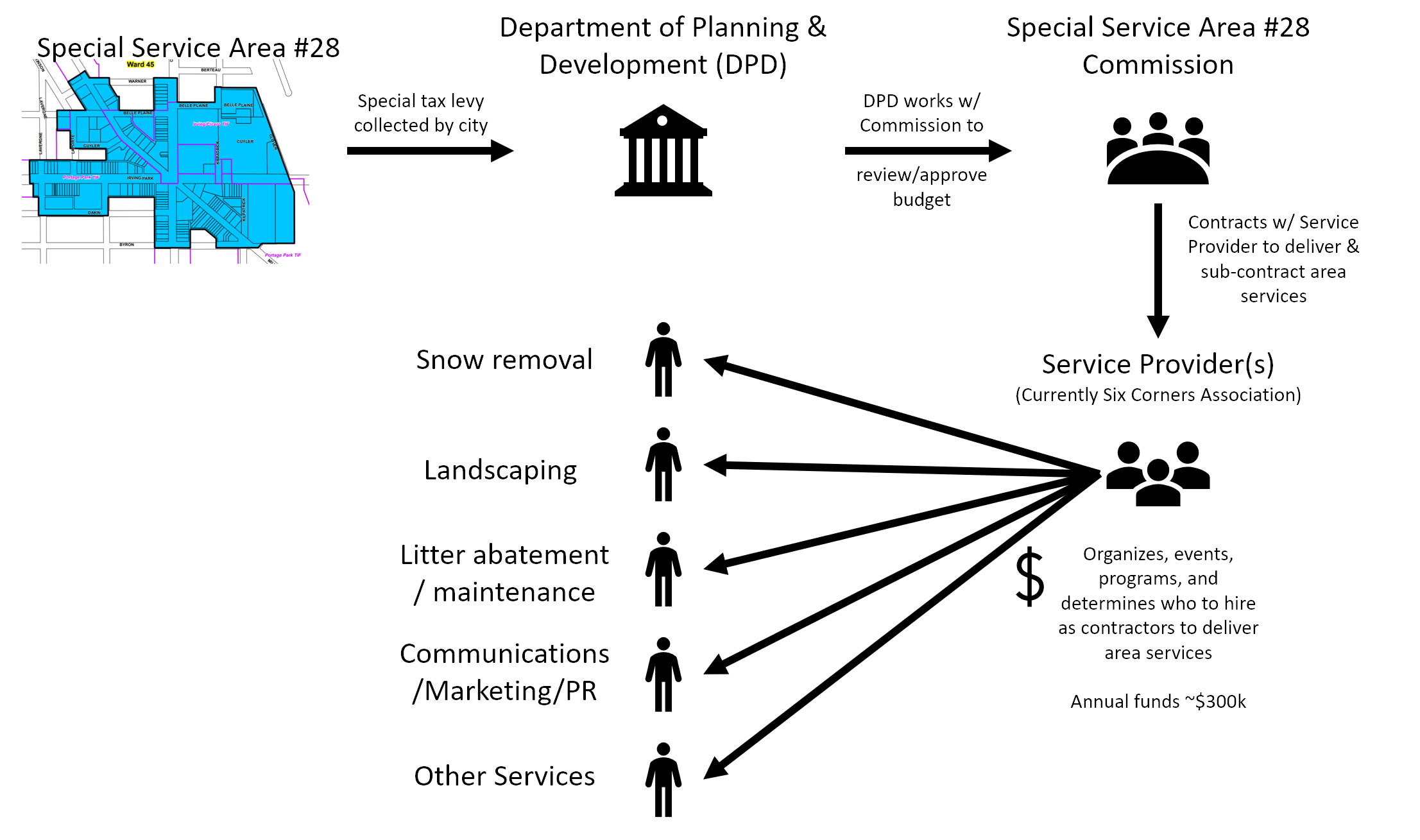

A picture is worth a thousand words…

This diagram depicts the boundaries of the SSA, and the relationships between DPD, the SSA, the current Sole Service Provider (Six Corners Association), and the types of vendors with which they contract to deliver services.

How much money are we talking about here?

The annual funds raised for the SSA are typically around $300,000, which the Sole Service Provider then spends on staff and contracted vendors to deliver services. The tax levy imposed for the year is reverse-engineered from the budget. If the SSA determines they want $300,000 to spend for the year on services and programs, then the property tax levy imposed on area businesses and residents within the SSA boundary will be whatever would generate $300,000 in funds.

How much money are we talking about for business owners? Let’s look at SSA Commissioner / Treasurer Mike Dimeo’s Singer Sewing store at 4914 W Irving Park Rd as an example. Based on the assessed value of his property and the tax levy of 0.006973, which had remained unchanged for five years, his business incurs an additional tax of $570/year in exchange for all of the services, marketing, and programs delivered throughout the year.